The collectibles market is an ever-evolving landscape, constantly shaped by market trends, cultural shifts, and, perhaps most notably, the results of high-profile auctions. Auctions, which offer some of the rarest and most valuable collectibles, serve as barometers for the overall health of the market. Every significant auction results in a ripple effect, influencing investor sentiment, pricing trends, and the broader direction of the industry.

As the next big auction approaches, many eyes are on the results, eager to see which rare items will fetch extraordinary prices and which categories of collectibles are gaining traction. But how exactly will the outcomes of this auction affect the future of the collectibles market? Let’s take a closer look at how auction results can shape market dynamics and what trends we can expect to emerge.

1. Price Records and the Market’s Perception of Value

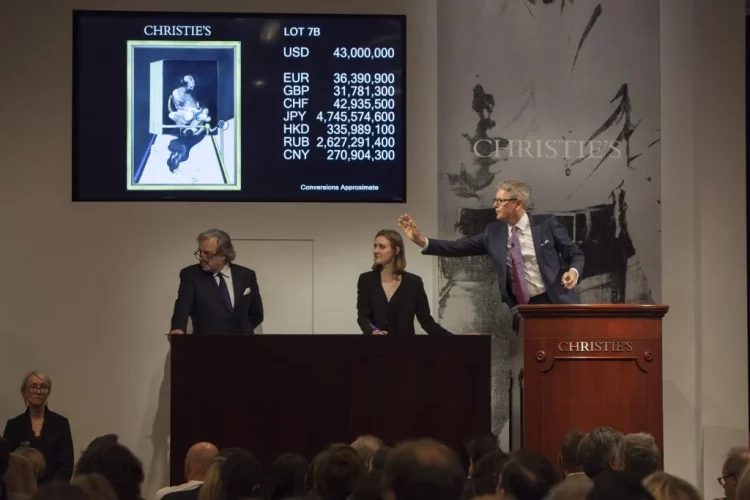

One of the most immediate ways that auction results affect the collectibles market is through the setting of new price records. High-profile sales, particularly those of rare and iconic items, can serve as benchmarks for future transactions. When a collectible fetches a price that exceeds expectations, it can lead to a shift in how other similar items are valued.

Impact:

- Setting New Standards: When a rare collectible, such as a painting by a world-renowned artist, a limited-edition watch, or a vintage car, achieves an all-time high at auction, it signals to the market that prices for similar items could potentially reach those levels in the future. This sets a new standard for what collectors and investors are willing to pay for comparable pieces.

- Rising Prices Across Categories: Auctions that achieve record-breaking prices often cause a ripple effect throughout the market. Items that are similar in style, brand, or rarity can see an increase in value as collectors and investors adjust their expectations based on the latest results.

Example:

- Fine Art Sales: The auction of high-value pieces, such as those by Picasso or Monet, has historically led to increased prices for artworks from other Impressionist or Post-Impressionist artists. These results drive home the idea that art as an investment continues to grow in worth.

2. The Influence of Provenance on Demand

Provenance — the history of ownership of a collectible — has always played a crucial role in determining its value. Items with a documented and prestigious provenance often command higher prices at auction. The results of an auction that features objects with notable provenance can influence trends in other sectors of the market.

Impact:

- Growing Interest in Provenance: If an item with a prestigious or unique history fetches a significant price at auction, collectors and investors will begin to place greater value on provenance across other categories. For instance, an antique car that was previously owned by a famous celebrity could see its price rise dramatically at auction, sparking greater interest in similar items.

- Shifting Collector Priorities: Auction results can lead to increased demand for items with clear and documented provenance. Collectors may begin seeking out rare pieces with verifiable histories, which could influence their buying decisions for future acquisitions.

Example:

- Celebrity-Linked Memorabilia: Auction sales of items that once belonged to famous figures — from movie stars to political leaders — frequently result in increased prices for similar pieces. The sale of Elvis Presley’s personal items at auction, for example, helped solidify the value of celebrity memorabilia as an investment category.

3. Emerging Collectible Categories and Changing Consumer Preferences

The outcome of an auction can reveal shifts in consumer preferences, spotlighting emerging collectible categories that are gaining momentum. When collectors bid aggressively on certain items or categories, it often signals the emergence of a new trend or a growing area of interest within the market.

Impact:

- New Trends in Collecting: If a particular type of collectible, such as digital art, NFTs, or vintage sneakers, attracts higher-than-expected bids, it can lead to increased interest and investment in that category. Auction results can also highlight previously overlooked categories that are gaining traction.

- Changing Tastes and Market Demands: The auction results may reflect a change in buyer demographics or cultural interests. Younger collectors, for example, have shown increasing interest in digital art and NFTs, and a record-breaking NFT sale at auction could lead to even greater participation in this space.

Example:

- NFTs and Digital Art: The sale of high-profile digital art pieces such as Beeple’s Everydays: The First 5000 Days for $69 million was a defining moment in the growing NFT market. Following that auction, interest in NFTs and digital collectibles surged, signaling the mainstream adoption of digital assets in the collectibles space.

4. Impact on Investor Sentiment and Market Liquidity

For many collectors, an auction is more than just a place to buy or sell items — it’s also a barometer of market sentiment. The results of high-stakes auctions can reveal whether investor confidence is growing or waning, which in turn affects liquidity in the market.

Impact:

- Optimism and Market Confidence: Strong auction results often boost investor sentiment, encouraging more collectors and investors to participate in the market. Higher-than-expected prices can increase demand for certain types of collectibles, resulting in greater liquidity and more active trading in those categories.

- Cautious Optimism or Decline: On the flip side, if an auction results in lower-than-expected sales or a lack of interest in high-value items, it could signal a slowdown in certain market sectors. This could lead investors to take a more cautious approach in future purchases, slowing the pace of sales and reducing liquidity in the market.

Example:

- Luxury Watches: The auction of a rare vintage Rolex may spark a surge of interest from investors looking for secure, tangible assets. A strong result would encourage further investment, whereas weaker outcomes might prompt investors to look elsewhere for returns.

5. Influencing Auction House Strategies and Marketing Approaches

The results of major auctions can directly influence the strategies employed by auction houses. If a particular category of collectibles performs exceptionally well, auction houses will take note and likely adjust their marketing and selection strategies for upcoming sales.

Impact:

- Refined Focus on High-Performing Categories: Auction houses may place a greater emphasis on certain categories, such as fine art, vintage cars, or rare books, if these areas show consistent growth in auction results. As a result, future auctions will feature more of these collectibles, further driving demand.

- Adjusting Auction Formats: Auction houses may also modify their formats based on results. For example, if an auction focusing on digital art or pop culture memorabilia proves successful, more frequent themed auctions might be organized to cater to niche markets.

Example:

- Themed Auctions: After the success of niche auctions, such as one dedicated to rare sports memorabilia or vintage comic books, auction houses may decide to specialize in these categories, offering dedicated sales that attract a specific set of collectors.

6. Influence on Global and Regional Collectibles Markets

The results of large, international auctions can influence regional markets, as they reflect broader global trends. For instance, auction outcomes in major cities like New York, London, and Hong Kong may affect the demand for certain types of collectibles in other parts of the world.

Impact:

- Cross-Border Influence: Strong results in one major market can lead to increased global interest in those categories. A record-setting auction of Asian art in Hong Kong may spur interest in similar items across Europe and the U.S., for example.

- Regional Trends and Preferences: Conversely, the auction results may highlight regional preferences or regional-specific collectibles. For instance, a strong performance for rare American muscle cars at a U.S.-based auction might lead to heightened interest in similar models in other markets, such as Europe or Asia.

Conclusion: Auction Results as Market Shapers

The results of the next big auction will undoubtedly have far-reaching consequences on the collectibles market. Whether it’s setting new price records, spotlighting emerging trends, or shifting investor sentiment, auctions continue to serve as a key indicator of market health and direction. Collectors, investors, and auction houses will closely watch the outcomes to adjust their strategies and make informed decisions about future acquisitions.

As the auction world continues to evolve, understanding the influence of auction results on the broader market is crucial for anyone involved in the collectibles space. For those looking to invest or collect, staying informed on these trends will help position them for success in the ever-changing world of collectibles.