The collectibles market is a dynamic and often unpredictable realm, where pricing mechanisms are not as straightforward as in other asset classes such as stocks or bonds. Collectibles, whether they are sports memorabilia, rare coins, vintage cars, fine art, or even comic books, have both subjective and objective value. In periods of market volatility, understanding how to navigate these pricing mechanisms becomes crucial for collectors, investors, and sellers who want to make informed decisions.

The complexity of pricing in the collectibles market arises from several factors, including rarity, condition, provenance, demand, and the economic environment. These factors are often influenced by social, cultural, and economic changes, which can lead to rapid fluctuations in prices. In this article, we will explore how to understand pricing in a volatile market, identify the key elements that affect prices, and provide practical tips for navigating the market amid uncertainty.

Understanding the Fundamentals of Pricing in the Collectibles Market

To navigate the volatility of the collectibles market, it’s essential to first understand the key elements that drive pricing. Unlike traditional financial assets, collectibles do not have a clear-cut, standardized pricing structure. Their value is often based on subjective factors such as rarity, emotional appeal, and demand. Here’s an overview of the primary elements that contribute to the pricing of collectibles:

1. Rarity and Scarcity

One of the most fundamental principles in pricing collectibles is rarity. The scarcer an item is, the more valuable it generally becomes. Rarity can be driven by the limited supply of a particular item, such as a limited-edition comic book, a mint-condition sports card, or an artist’s first painting. However, rarity alone does not guarantee high prices—it must also be accompanied by demand.

Scarcity often creates competition among buyers, which can inflate prices during times of heightened interest. Conversely, the market for rare items can collapse if interest wanes, making it a volatile factor in pricing.

2. Condition and Grading Systems

The condition of a collectible plays a pivotal role in its pricing. Collectibles, particularly vintage items, are often assessed and priced based on a grading system. For example, in the comic book market, the grade of a book is determined by its physical condition, with higher-grade books (in near-mint condition) fetching much higher prices than those with visible wear and tear.

Other types of collectibles, such as sports memorabilia, vintage watches, and fine art, also employ grading systems. These systems can vary depending on the type of collectible but generally include categories like excellent, good, fair, or poor condition. Collectibles in pristine or near-mint condition will command higher prices than those that have been damaged or restored, so understanding these grading systems is essential for pricing items effectively.

3. Provenance and Authenticity

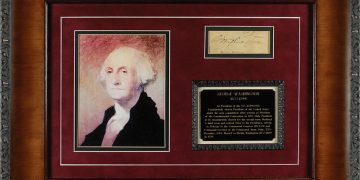

Provenance refers to the documented history of an item, including its origin, past ownership, and any previous sales or auctions. Items with well-documented provenance often fetch higher prices because their history provides additional value and context. For example, a piece of art once owned by a famous collector or an autographed sports jersey worn by a legendary athlete carries significant historical and cultural weight.

Authenticity is another critical factor in pricing. The collectibles market is rife with counterfeit items, and the value of a collectible item is significantly reduced if it cannot be verified as authentic. Authenticity certificates, third-party grading, and detailed documentation play an essential role in ensuring that an item can be accurately priced. Without verified authenticity, pricing can become highly subjective, and the value of the item is often contested.

4. Demand and Popularity

Pricing in the collectibles market is also highly influenced by current demand and popularity. Items that align with contemporary cultural trends or have a prominent place in popular media often see surges in pricing. For example, comic books featuring popular superheroes or limited-edition sports memorabilia associated with well-known athletes are subject to fluctuations based on public interest.

The popularity of an item can be fleeting, with certain trends experiencing periods of rapid growth followed by declines. Recognizing these cycles of demand and understanding the relationship between supply and demand is crucial when determining when to buy or sell collectibles.

5. Economic and Market Cycles

The broader economic environment significantly affects the collectibles market. Periods of economic expansion tend to increase disposable income, which can drive up demand for luxury goods, including high-end collectibles. In contrast, during economic downturns or recessions, collectors and investors may be less willing to spend on non-essential items, leading to a decrease in demand and a subsequent reduction in prices.

The overall state of the market plays a role as well. When economic uncertainty increases, people tend to be more cautious with discretionary spending, which can cause collectibles to lose value temporarily. During more stable or booming economic periods, the opposite may occur, and the market for collectibles can become more vibrant, pushing prices higher.

Navigating Pricing in a Volatile Market

While pricing in the collectibles market can be influenced by many factors, the real challenge lies in navigating volatility. Market fluctuations can happen suddenly and without warning, and prices can change rapidly due to shifts in demand, economic conditions, or societal trends. Here are some strategies for dealing with volatility:

1. Conduct Thorough Research

The key to understanding pricing in a volatile market is research. Whether you’re buying, selling, or simply evaluating your collection, you need to be aware of current market conditions. This includes understanding recent trends in auction results, sales prices, and the popularity of specific collectible categories.

Consulting expert guides, collector forums, and historical data on similar items can give you a better understanding of what to expect in terms of pricing. Websites like eBay, auction house results, and specialized collectibles marketplaces can be invaluable tools for keeping track of price trends.

2. Track Historical Data and Market Performance

Price fluctuations in the collectibles market often follow certain patterns. For instance, while individual items may fluctuate in value based on demand, the general trend of certain categories, like rare coins or art, may follow long-term growth patterns. By studying historical pricing trends and market performance over several years, you can anticipate potential growth or decline in value.

Specialized pricing indices, auction results, and sales reports can help track the performance of specific categories of collectibles. Understanding the broader market movements will help you recognize when an item’s value is likely to stabilize, increase, or decrease.

3. Diversify Your Collection

Given the volatile nature of the collectibles market, diversification is a sound strategy for minimizing risk. Focusing on a range of items from different categories allows you to balance your portfolio and reduce the impact of market shifts. For example, if the market for rare comic books is experiencing a downturn, your collection of vintage watches or rare sports memorabilia may still be performing well.

Diversifying helps ensure that you’re not overly dependent on the success or failure of any one collectible category, providing a cushion against volatility.

4. Be Prepared for Market Cycles

The collectibles market often follows cycles of boom and bust, and being prepared for these fluctuations can help you make better decisions when pricing your items. Understanding the lifecycle of a collectible, from its initial release to its peak in popularity and eventual decline, will allow you to determine when to buy, hold, or sell.

For example, if you acquire an item when it is newly released or relatively unknown, you might be able to sell it for a significant profit when the market becomes more interested in that item. However, if you hold onto the item too long, you risk it losing value as interest wanes. Being able to predict these cycles is crucial for successful navigation in a volatile market.

5. Focus on Timeless, High-Quality Collectibles

In the face of volatility, it’s often wise to focus on items that have enduring value. These are typically high-quality collectibles with a proven track record of appreciation over time. Classic art pieces, rare coins, vintage jewelry, and first-edition books often hold their value and can even increase in price during economic downturns. They tend to be less susceptible to the whims of popular culture and cyclical trends.

While such collectibles may not experience the extreme price fluctuations of trend-driven markets, they offer stability in the long term. These items tend to attract serious collectors and investors who are less swayed by short-term price movements, making them more resilient in volatile times.

Understanding the Role of Auctions in Pricing

Auctions are a central part of the collectibles market, and understanding how auction dynamics work is crucial for navigating pricing in a volatile market. Auctions are often where collectors see the most pronounced fluctuations in pricing. The excitement of bidding wars can drive prices up unexpectedly, while the lack of competition can lead to items being sold for far less than expected.

1. Study Auction Results

By studying auction results from prominent houses like Sotheby’s, Christie’s, or specialized auction platforms, you can gauge the performance of specific types of collectibles. Auction results provide valuable data on the final prices for specific items, giving you insight into the current market value of particular collectibles.

It’s important to track not only the final selling prices but also the frequency and success of auction sales in particular categories. High auction volumes with successful bids suggest a strong market, while low volumes or unsold items may indicate a softer demand.

2. Consider Timing When Using Auctions

Timing is crucial when participating in or observing auctions. Auctions that take place during periods of heightened demand or cultural interest can yield higher prices. On the other hand, auctions held during off-seasons or economic downturns may result in lower-than-expected prices. Being aware of these cycles can help you time your buying and selling strategies effectively.

Conclusion

Pricing in the volatile collectibles market is a complex process, influenced by a combination of factors such as rarity, condition, demand, and economic cycles. By understanding these mechanisms and developing strategies to navigate market fluctuations, collectors and investors can make informed decisions and minimize risk. Conducting thorough research, tracking historical data, diversifying collections, and focusing on timeless items are essential for succeeding in this unpredictable market. By staying informed and flexible, collectors can not only survive but thrive amid uncertainty.