The concept of collecting has been part of human culture for centuries. People have always cherished objects that held personal, cultural, or financial value. From rare baseball cards to vintage cars, collectors have dedicated their lives to amassing impressive collections. However, in recent years, a new era of collecting has begun to emerge, one that is entirely digital. Digital collectibles and Non-Fungible Tokens (NFTs) are reshaping the world of collecting, bringing new opportunities, challenges, and transformations to the market. This article will explore the rise of digital collectibles and NFTs, how they are transforming traditional collecting, the impact of NFTs on auctions and pricing trends, and recent updates on major NFT auction results.

The Rise of Digital Collectibles and NFTs in the Market

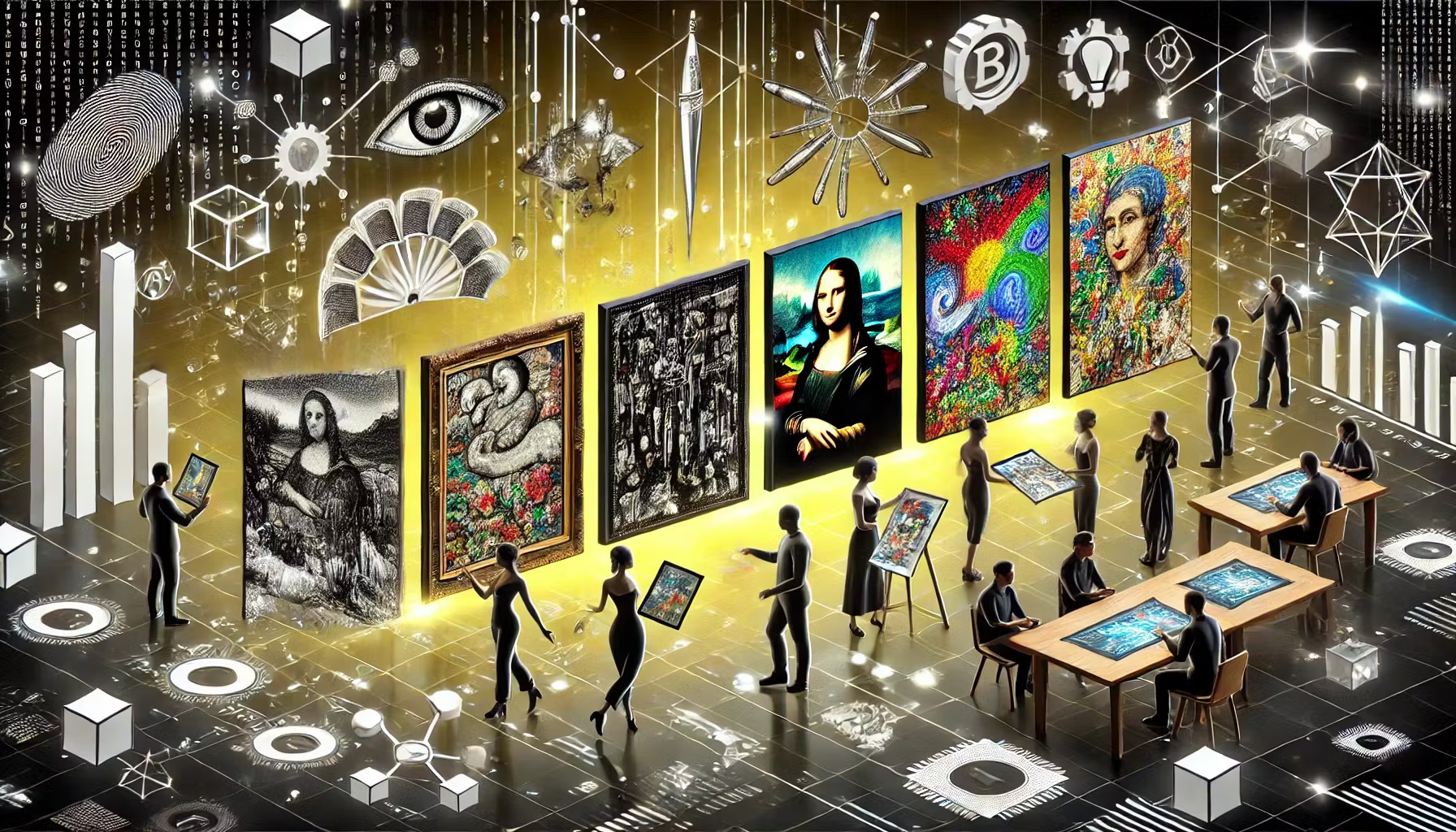

The rise of digital collectibles and NFTs marks a seismic shift in the collecting world. Unlike traditional collectibles, which are tangible items that can be touched and held, digital collectibles exist solely in digital form. These items are often unique and can range from digital artwork and music to virtual real estate and even virtual pets. The idea behind digital collectibles is that they are one-of-a-kind or limited edition pieces that hold intrinsic value to the collector, similar to their physical counterparts.

Non-Fungible Tokens, or NFTs, are at the heart of this revolution. NFTs are a type of cryptocurrency token that represent ownership of a unique digital item. These tokens are built on blockchain technology, which ensures that each NFT is distinct and verifiable, making it impossible to replicate. The blockchain also acts as a public ledger, allowing buyers and sellers to track the provenance of the item and ensure its authenticity. This technology has provided digital assets with a new level of security and transparency that was previously unavailable.

The NFT market exploded in 2021, with sales reaching over $17 billion by the end of the year. Major auction houses such as Christie’s and Sotheby’s began to host NFT auctions, and high-profile artists, celebrities, and companies jumped on the NFT bandwagon. This surge in popularity was fueled by the rise of cryptocurrencies, as NFTs are typically bought and sold using digital currencies like Ethereum. The decentralization of the blockchain also allowed for a more global marketplace, where collectors from all over the world could buy, sell, and trade these digital items.

How the Digital World is Transforming Traditional Collecting

Traditional collecting has always been tied to physical objects. People have collected coins, stamps, art, and memorabilia for centuries. These objects have a tangible value because they can be touched, displayed, and often used as status symbols. However, the digital world has begun to change this paradigm. Digital collectibles, by their very nature, are intangible. They exist only in cyberspace, often taking the form of images, videos, or other types of media. While this might seem like a stark contrast to traditional collecting, the value of digital collectibles is built on scarcity, uniqueness, and authenticity—just like physical items.

One key advantage of digital collectibles is the ease with which they can be traded. Traditional collectibles require physical storage, insurance, and often expensive transportation costs when being sold. Digital collectibles, on the other hand, can be easily bought, sold, and transferred online, making the process more efficient and accessible. This has opened up the world of collecting to a much broader audience, including younger generations who are more familiar with digital technologies.

Moreover, digital collectibles are not bound by physical limitations. They can exist in virtual worlds, like video games or virtual reality environments, where they can be interacted with in new and innovative ways. For example, players in virtual games can collect in-game items that have real-world value, such as weapons, skins, or virtual land. These items can be sold or traded within the game’s ecosystem, or even outside of it, using NFTs.

The Impact of NFTs on Auctions and Pricing Trends

One of the most significant impacts that NFTs have had on the world of collecting is their influence on auctions and pricing trends. Traditional auction houses like Sotheby’s and Christie’s have long been key players in the high-end collectible market, but the emergence of NFTs has introduced a new dynamic to the auction scene. In March 2021, the digital artist Beeple made headlines when his NFT artwork titled “Everydays: The First 5000 Days” sold at Christie’s for a staggering $69.3 million. This was one of the highest prices ever paid for a work of digital art and demonstrated that NFTs could command prices on par with traditional artworks.

NFTs have also affected the pricing of digital collectibles by introducing the concept of scarcity. Unlike physical collectibles, which are often produced in limited quantities, digital items can be infinitely copied. However, the use of NFTs ensures that only one version of a particular item exists in its original form. This scarcity, combined with the artist’s reputation or the item’s historical significance, can drive the price of digital collectibles to extraordinary levels.

Auction houses have responded to this shift by launching their own NFT marketplaces. For instance, Christie’s and Sotheby’s have created dedicated platforms for NFT sales, where collectors can bid on unique digital items. This has further legitimized the NFT market and opened up new opportunities for both established artists and emerging talent to monetize their work. Additionally, online platforms like OpenSea and Rarible have emerged as major marketplaces for buying and selling NFTs, allowing anyone to participate in the growing market.

However, the volatility of the NFT market has also led to concerns about pricing bubbles. While some NFTs have sold for record-breaking prices, others have seen their value plummet. The speculative nature of the market, driven by hype and the fear of missing out (FOMO), has made it difficult to predict long-term trends. As a result, many collectors view NFTs as a high-risk investment, while others are drawn to the thrill of owning unique digital assets, regardless of their financial value.

Recent Updates on Major NFT Auction Results

The NFT market continues to evolve, with new records being set and significant sales taking place on a regular basis. In addition to Beeple’s record-breaking sale, other high-profile NFT auctions have captured the public’s attention. For example, in December 2021, the “CryptoPunk #7804” NFT sold for 4200 Ethereum, or approximately $7.6 million at the time of the sale. CryptoPunks, one of the earliest and most famous NFT collections, have become highly sought after by collectors, with certain punks commanding prices in the millions.

In addition to individual sales, entire collections have also achieved impressive auction results. In February 2022, a collection of NFTs from the Bored Ape Yacht Club, a popular series of digital artwork featuring unique cartoon apes, sold for over $24 million at Sotheby’s. The Bored Ape Yacht Club has become one of the most valuable and recognizable NFT collections, with high-profile celebrities such as Eminem, Snoop Dogg, and Paris Hilton purchasing and displaying their own Bored Apes.

The NFT space has also seen a rise in celebrity-driven projects. For example, rapper Snoop Dogg launched his own collection of NFTs, which sold out within minutes of release. Other celebrities, such as Grimes and Jack Dorsey, have also entered the NFT market, using their fame to generate interest and demand for their digital collectibles.

Despite the occasional backlash against NFTs due to concerns about environmental impact and speculative bubbles, the market shows no signs of slowing down. As blockchain technology evolves and more industries explore the potential of NFTs, the future of digital collectibles looks promising.

Conclusion

The rise of digital collectibles and NFTs has revolutionized the world of collecting. What was once a hobby tied to physical objects has now expanded into a digital realm where uniqueness, scarcity, and authenticity are the driving forces behind value. Traditional auction houses and collectors have embraced NFTs, and major sales have demonstrated that these digital assets can command significant prices. While the market remains volatile and speculative, the innovations brought about by NFTs have forever changed the way we think about collecting. Whether NFTs will continue to thrive in the long term remains to be seen, but for now, they represent the future of collecting in a digital world.