Auctions have long been a cornerstone of the collectibles market, providing an open and transparent space for buying and selling rare items. In this environment, the competitive nature of bidding often results in surprising outcomes—items that outperform their expected prices or create an unexpected frenzy in the auction room. While most collectors are familiar with the idea that auctions can sometimes lead to exceptional prices, few fully understand the complex dynamics that contribute to these surprising results.

This article will take a deep dive into the auction process, uncovering the factors that can lead to certain items outperforming expectations. We’ll explore the role of bidders, the psychology of auctions, the impact of trends, the auction house’s influence, and the many other dynamics that shape the outcome of an auction. By understanding these factors, collectors can better navigate the auction world and gain a clearer insight into how and why certain collectibles go for much more than anticipated.

The Auction House’s Role in Setting Expectations

Auction houses are the intermediaries that facilitate the auction process, but they also play a critical role in setting the initial expectations for how an item will perform. They typically provide a pre-auction estimate that sets the range of prices for the items up for bidding. These estimates are based on a combination of historical data, market trends, and the auction house’s expertise.

1. The Role of Pre-Auction Estimates

Before the auction takes place, each item is assessed, and an estimated value is provided. This estimate, while useful, is rarely a prediction of the final price—rather, it is an informed range based on previous sales of similar items, the rarity of the item, and its condition. However, these estimates can influence bidders’ behavior. If an item is estimated to sell for a significant amount, it may attract more attention from high-profile buyers, but it can also set expectations in such a way that the bidding will stall if it doesn’t generate enough excitement.

It is essential to understand that auction houses are often conservative in their estimates, as they want to avoid overpromising and underdelivering. When an item exceeds its pre-auction estimate, it is a testament to the competitive nature of the auction and the specific dynamics surrounding that item.

2. Auction House Reputation and Influence

The auction house itself plays a pivotal role in the dynamics of an auction. Well-established houses like Sotheby’s, Christie’s, and Heritage Auctions attract top-tier collectors, investors, and dealers, which often leads to higher bids. These houses have strong reputations and a network of buyers that can drive demand for items.

Additionally, auction houses can influence the final price of an item through their marketing and promotional efforts. By showcasing a specific item heavily through catalogs, private viewings, and other forms of promotion, they can draw attention to it and generate greater interest. This is one of the key reasons why certain items outperform their expectations—they’ve been effectively marketed to an eager group of potential buyers.

The Bidding Process and Psychological Factors

While auction houses are instrumental in setting expectations and curating items for sale, the bidding process itself is often where the most unexpected results arise. Auctions are inherently competitive, and the psychology behind bidding can be unpredictable.

1. Bidder Psychology: The Role of Emotions and Competition

One of the most significant factors that contribute to unexpected auction results is the psychology of the bidders. The competitive nature of auctions can lead to emotional decision-making. As the price for an item rises, bidders can experience a “fear of missing out” (FOMO), which drives them to increase their bids to ensure they don’t lose out on the item. This is particularly common with rare or highly desirable items, where there is a perceived scarcity.

Additionally, the “anchoring effect” often plays a role in auction behavior. Bidders anchor their expectations around the pre-auction estimate and the current bid. As the price climbs, bidders may anchor their bids to round numbers or significant milestones, pushing the price even higher than anticipated.

2. The Winner’s Curse

The “winner’s curse” is a phenomenon in which the winning bidder ends up paying more for an item than it is worth, based on their emotional decision-making during the auction. This can happen when bidders become caught up in the excitement of the bidding process and bid beyond their initial valuation of the item. The winner’s curse is most common in highly competitive auctions, where two or more parties are determined not to lose, regardless of the price.

This psychology of bidding can cause items to exceed their estimates, sometimes by a large margin. It’s one of the main reasons why some collectibles see unexpected results. An item that may have been predicted to fetch $50,000 could end up selling for $100,000 or more if bidding reaches a fever pitch, fueled by bidders’ emotions and competitive instincts.

3. The Influence of Auction Pace

Another aspect of bidding dynamics is the pace at which an auction progresses. The faster the pace, the more likely bidders are to make quick, impulsive decisions. In some high-end auctions, items can be bid on for only a few seconds before moving on to the next lot. This speed can fuel momentum and increase the intensity of the bidding, leading to higher final prices.

The Impact of Market Trends and Cultural Factors

In addition to the auction house’s influence and the psychology of the bidders, broader market trends and cultural shifts also play an important role in determining which items outperform expectations. Collectibles are highly influenced by social and cultural factors, and their value can fluctuate in line with changes in the market.

1. The Power of Trends and Pop Culture

Cultural trends and shifts in popular interests can heavily influence the value of certain types of collectibles. For instance, the value of comic books has surged in recent years due to the popularity of superhero films and television shows. Similarly, the rise of NFTs (Non-Fungible Tokens) has had a profound impact on digital art and collectibles, leading to higher-than-expected sales in these areas.

When a specific trend or cultural movement gains traction, it can elevate the demand for collectibles related to that trend. This can create competition among bidders who are eager to capitalize on the movement, pushing prices higher than initially predicted. For example, vintage video games and action figures from the 1980s and 1990s saw an unexpected rise in value during the pandemic, as people sought out nostalgic items from their childhood.

2. Economic Factors and the Influence of Wealth

Economic factors, including shifts in disposable income and the broader investment landscape, can also affect bidding behavior. When the economy is doing well, collectors may feel more confident in making larger purchases, knowing that their investments are more likely to appreciate in value. Conversely, in periods of economic downturn, bidders may become more cautious, leading to less competition and lower final prices for certain items.

Wealthy individuals and investors also play a significant role in driving up auction prices. High-net-worth individuals tend to seek out rare and unique items as status symbols or investments, and their presence in auctions can lead to inflated prices. This is particularly true for fine art, classic cars, luxury watches, and rare jewelry—categories where buyers are often willing to pay a premium for exclusivity and rarity.

The Role of Rarity, Condition, and Provenance

Not all collectibles are created equal. In the auction world, certain factors—such as rarity, condition, and provenance—can dramatically affect the performance of an item. Understanding these elements is key to understanding why some items outperform expectations.

1. Rarity and Scarcity

In the collectibles market, rarity is a critical factor that drives demand. Items that are one-of-a-kind or produced in limited quantities often fetch higher prices at auction due to their scarcity. For example, rare trading cards, limited-edition artwork, or historically significant objects tend to attract more attention from bidders because of their uniqueness.

However, even items that are technically rare may not always outperform expectations. The degree of rarity must align with demand for the item. A rare collectible that doesn’t appeal to a large audience or lack the historical significance may still fail to reach its expected value.

2. Condition and Preservation

The condition of a collectible is another important factor in determining its value at auction. Collectibles that have been well-preserved—whether it’s a vintage watch in pristine condition or a comic book with no tears or stains—will command higher prices than those that are damaged or show signs of wear and tear. Bidders are often willing to pay a premium for items in excellent condition, especially when the item is rare or highly desirable.

3. Provenance and History of Ownership

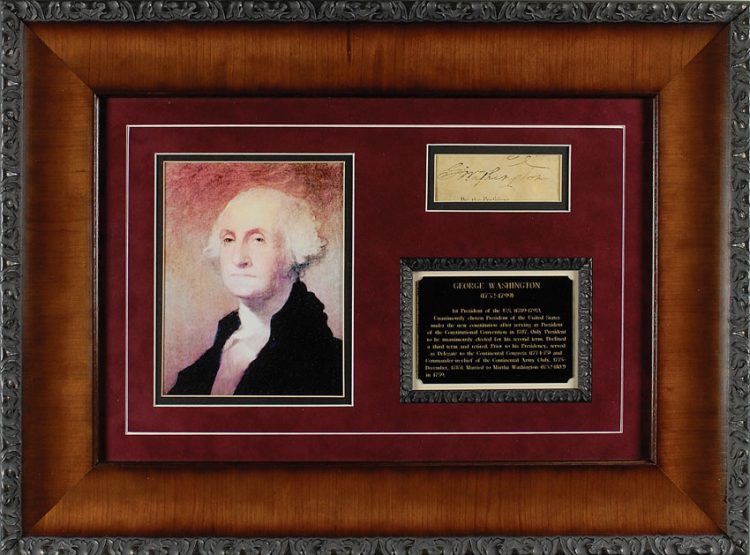

Provenance, or the documented history of an item’s ownership, plays a significant role in determining its value at auction. Items with a notable history—such as those previously owned by famous individuals or those associated with important historical events—can command higher prices than similar items without such a pedigree.

For example, a vintage Rolex once owned by a famous movie star or a piece of art that once hung in a world-renowned museum can fetch much higher prices than an identical piece without such a history. The aura of exclusivity and fame that comes with provenance can significantly drive up demand and, in turn, result in auction prices far beyond expectations.

Conclusion

Auction results are often unpredictable, and the prices that certain items fetch at auction can sometimes defy expectations. Understanding the dynamics that contribute to these surprising outcomes can give collectors a strategic advantage in navigating the auction world. From the influence of the auction house and the psychology of bidding to broader market trends and the role of rarity, condition, and provenance, there are numerous factors at play in the auction environment.

Collectors who take the time to understand these dynamics can make more informed decisions, spot emerging trends, and anticipate the factors that might lead certain items to outperform their initial estimates. Auctions will always have an element of unpredictability, but by understanding the forces that shape auction outcomes, collectors can gain insight into how and why certain items exceed expectations, giving them the tools to refine their own collecting strategies.