Introduction: Overview of the Rise of Digital Collectibles (NFTs, Digital Art, etc.)

In the last few years, the emergence of digital collectibles has reshaped the art and collectibles market in ways that were once thought unimaginable. Digital collectibles, including Non-Fungible Tokens (NFTs), digital art, virtual real estate, and other blockchain-based assets, have experienced explosive growth, with high-profile sales and increasing mainstream adoption. These collectibles are unique digital items that cannot be replicated or exchanged on a like-for-like basis. They exist on blockchain networks, where each item is recorded in a decentralized ledger, ensuring transparency and authenticity. NFTs, in particular, have gained immense popularity in various sectors, including art, music, gaming, and even fashion.

The NFT market saw a meteoric rise in 2021, with several high-profile auction sales drawing global attention. The sale of Beeple’s “Everydays: The First 5000 Days” at Christie’s for $69 million marked a watershed moment for the digital art world and demonstrated how digital assets could fetch monumental prices at traditional auction houses. This monumental event brought NFTs and digital art to the forefront, signaling a shift in how we think about ownership, provenance, and value in the digital realm.

The allure of digital collectibles lies not only in their rarity and uniqueness but also in the concept of ownership that NFTs provide. The blockchain technology behind these collectibles ensures verifiable ownership, creating a secure and transparent system for digital assets. Additionally, the interactivity and programmability of digital assets open up new possibilities for creators and collectors, further enhancing the value of digital collectibles in the modern auction scene.

Impact on Traditional Auctions: How Digital Collectibles Are Being Integrated into Traditional Auction Houses

Traditionally, auction houses like Christie’s, Sotheby’s, and Bonhams have focused on physical art, antiques, and high-value collectibles. These institutions have long been regarded as the pinnacle of the auction world, setting standards for both the art market and the broader collectibles industry. However, the rise of digital collectibles has prompted these established auction houses to rethink their strategies and adapt to the growing demand for NFTs and digital art.

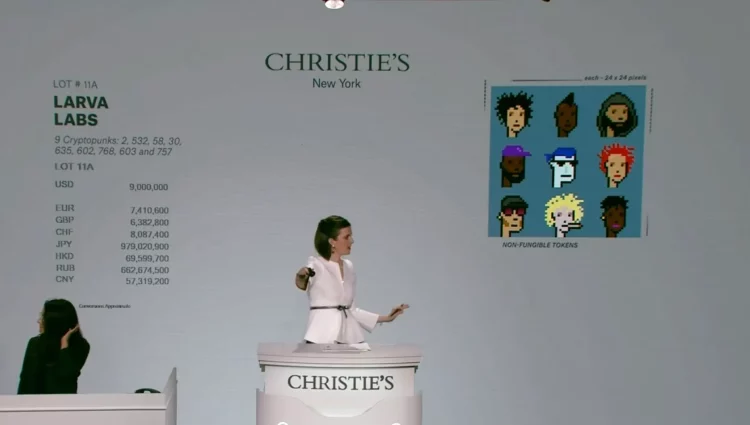

Christie’s, for example, was one of the first major auction houses to embrace digital collectibles. In March 2021, Christie’s held its first-ever NFT auction, which featured Beeple’s aforementioned piece, “Everydays: The First 5000 Days.” This auction set a precedent for the integration of digital art into the traditional auction world. The sale of Beeple’s work for $69 million was a significant milestone, demonstrating that digital collectibles were not just a passing trend but a new market force. Sotheby’s followed suit by hosting its own NFT auctions, including the sale of digital works by artists like Pak and CryptoPunk, both of which fetched millions of dollars.

These traditional auction houses have worked to ensure that digital collectibles receive the same level of respect and recognition as traditional works of art. One of the ways they’ve achieved this is by offering the option of purchasing NFTs with cryptocurrency, allowing digital-native buyers to transact seamlessly. The inclusion of NFTs in these prestigious venues has also validated the legitimacy and value of digital art and collectibles in the eyes of collectors, investors, and institutions.

In addition to hosting NFT auctions, auction houses have adapted by creating digital platforms designed specifically for selling digital art and collectibles. For example, Sotheby’s launched “Sotheby’s Metaverse,” an online platform dedicated to the sale of NFTs and digital assets. This has allowed these institutions to tap into a new, tech-savvy clientele while preserving their long-standing reputation for curating high-value collections. These platforms provide a digital space where buyers and sellers can interact in real time, making the auction process more accessible to a global audience.

Changes in Bidding Strategies: How Collectors and Investors Approach Digital Items in Auctions

The integration of digital collectibles into traditional auctions has also led to a shift in the way collectors and investors approach bidding strategies. The auction dynamics for digital assets differ from those of traditional art, creating unique challenges and opportunities for both experienced bidders and newcomers to the space.

One of the main differences is the speed and fluidity of bidding. In traditional auctions, especially for high-value art pieces, bidding can be a slow and deliberate process. However, in the world of NFTs, auctions are often characterized by fast-paced bidding wars, with bids jumping quickly and significantly. This is partly due to the digital nature of the assets being sold, which allows for instant transactions and real-time updates. Additionally, the excitement surrounding NFTs can create an intense atmosphere, with bidders competing for rare or highly sought-after works in ways that traditional collectors might not be accustomed to.

Another significant shift is the way collectors evaluate the value of digital collectibles. Traditional art auctions often rely on established metrics such as the artist’s reputation, historical significance, and provenance to determine the worth of a piece. However, when it comes to digital collectibles, factors like rarity, provenance on the blockchain, and the creator’s digital footprint play a more prominent role. The price of an NFT can also be influenced by its association with a particular platform or community, as some NFT marketplaces have become known for selling premium assets. The reputation of the digital artist, the uniqueness of the work, and the demand within the digital community all contribute to the final price.

For investors, bidding strategies for NFTs are increasingly focused on long-term appreciation. Many see NFTs as a speculative asset class, similar to how traditional art collectors view paintings or sculptures. As such, investment strategies in the digital collectible space often involve carefully selecting pieces with a strong potential for value growth. Some investors are looking for works by emerging artists or unique pieces that stand out in the NFT ecosystem, while others are drawn to more established names and well-known collections. This has led to the emergence of “NFT flipping,” where investors buy digital assets with the intention of reselling them for a profit, sometimes within a matter of days or weeks.

Bidding on digital collectibles also allows for a more global and democratized market. Unlike traditional auctions, which often have geographical constraints, the online nature of NFT auctions means that anyone with internet access can participate. This has led to a diversification of bidders, with collectors from different regions and backgrounds entering the market, often using cryptocurrency as their preferred means of payment.

Market Dynamics: Fluctuations in the Value of Digital Collectibles at Auctions

The market for digital collectibles is highly volatile, and this volatility plays a significant role in the auction process. Unlike traditional art, where the market can often be more stable, the NFT space is still in its infancy and subject to rapid fluctuations in value. The prices of digital collectibles can skyrocket in a matter of days or plummet just as quickly, creating a dynamic market that is both exhilarating and risky.

The rapid growth of the NFT market in 2021 led to a frenzy of speculative buying, with many investors flocking to digital collectibles in hopes of capitalizing on their sudden popularity. However, this speculative bubble has also resulted in some market corrections, as prices for certain digital assets have fallen from their peaks. For example, the price of some NFT art pieces has dropped dramatically since their initial sale, as the hype surrounding NFTs has begun to subside in certain segments of the market.

Despite these fluctuations, some digital collectibles have continued to perform well at auction, with high-profile pieces fetching substantial prices. The continued success of certain NFT projects, such as CryptoPunks and Bored Ape Yacht Club, demonstrates that there is a sustained interest in digital collectibles with strong community backing and unique appeal. The volatility in the market has also spurred more cautious bidding behavior, as collectors and investors alike weigh the risks and rewards of participating in NFT auctions.

Factors such as technological advancements, changes in blockchain protocols, and shifts in market sentiment can all impact the value of digital collectibles. The success of an NFT is often tied to the platform or marketplace where it is sold, the popularity of the creator, and the wider adoption of blockchain technologies. Additionally, the value of NFTs can be influenced by trends within the broader art world and the level of attention paid to digital collectibles by mainstream media.

Future Outlook: Predictions for the Digital Collectibles Market and Auction Trends

Looking ahead, the future of digital collectibles in the auction world appears promising, though it remains uncertain. Several key trends are likely to shape the market in the coming years.

First, the integration of digital collectibles into traditional auction houses will continue to evolve. As more auction houses experiment with NFT sales and digital art, we can expect further innovations in how digital assets are presented and sold. This could include new formats for virtual bidding, collaborations with blockchain platforms, and the development of specialized auction categories for different types of digital assets, such as virtual real estate or in-game items.

Second, the NFT space is likely to mature, with increased regulation and standardization. As the market matures, we may see greater transparency regarding the ownership and provenance of digital assets, making it easier for collectors and investors to assess the value of NFTs. Furthermore, the growth of decentralized finance (DeFi) and improvements in blockchain technology could lead to more seamless and secure auction experiences, further enhancing the appeal of digital collectibles.

Lastly, as more mainstream artists and celebrities enter the digital collectible space, the market could see further diversification in terms of the types of NFTs being sold. While art and music NFTs have garnered the most attention so far, other sectors such as sports memorabilia, fashion, and entertainment are beginning to explore the potential of blockchain-based collectibles.

Overall, the digital collectibles market will continue to evolve, creating new opportunities and challenges for collectors, investors, and auction houses alike. As technology improves and new platforms emerge, we can expect the role of digital collectibles in auctions to grow, further blurring the line between the traditional and digital art worlds.