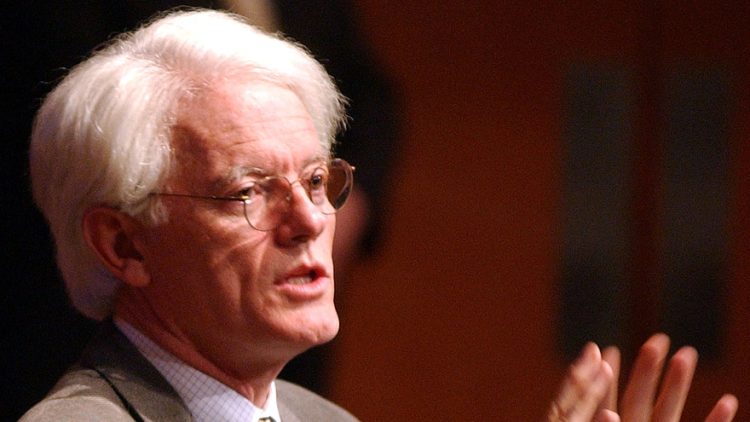

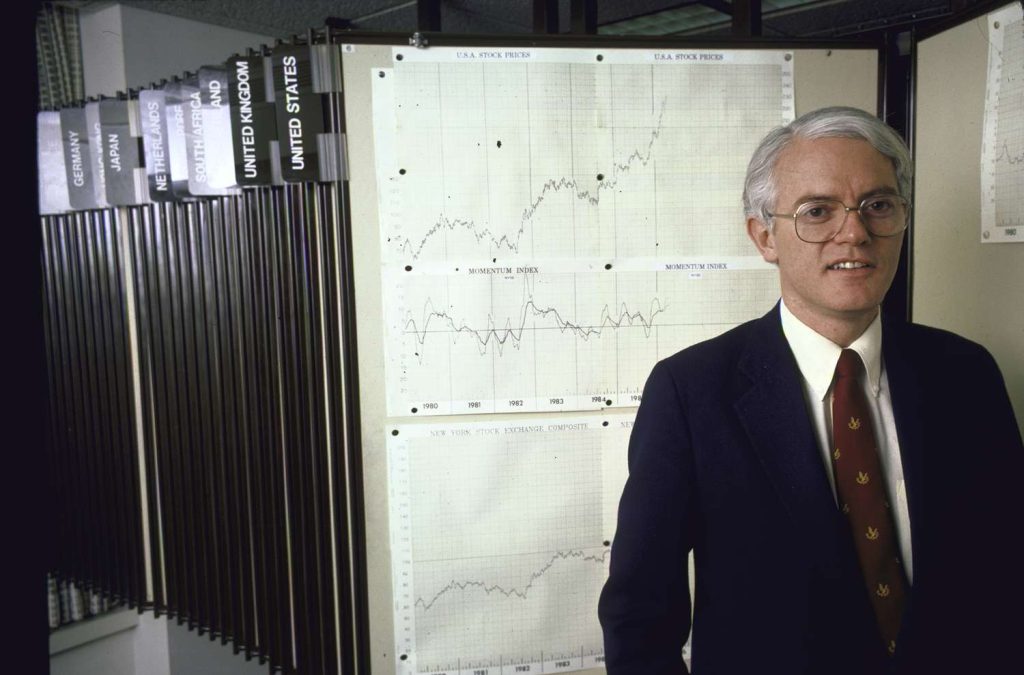

Peter Lynch, renowned for his successful management of the Magellan Fund at Fidelity Investments, is one of the most respected figures in the world of investing. Lynch’s ability to identify undervalued stocks and his unique approach to investment have become cornerstones of his legacy. However, what is perhaps less known is how Lynch applied the same investment philosophy that made him a legend in the stock market to the world of art collecting—and in doing so, achieved remarkable financial success.

This article explores how Peter Lynch translated his principles of stock investing into the art market and how his passion for collecting art resulted in substantial wealth growth. By applying the same strategies and concepts, Lynch was able to navigate the art market with the same discipline and foresight that made him a household name in finance.

1. The Core Investment Philosophy: Know What You Own

One of the fundamental principles behind Peter Lynch’s stock-picking success was his belief in investing in businesses or assets that he understood thoroughly. Lynch famously coined the term “invest in what you know,” which encourages investors to buy companies whose products or services they believe in and use. This philosophy can also be applied to art collecting. Lynch didn’t just buy art for the sake of owning it—he invested in works that resonated with him and fit his personal tastes and beliefs.

Lynch’s deep understanding of the art market, combined with his personal interest in certain genres and periods, allowed him to make informed decisions. For example, his collection includes works from both well-established artists and emerging contemporary talents, reflecting his belief that great art can be found at all levels of the market.

Key Takeaway: Lynch’s art collection strategy mirrors his approach to stock investment—he invests in what he understands and enjoys, ensuring that every piece aligns with his knowledge and passion. For aspiring art investors, this emphasizes the importance of having a deep understanding of the market and the works you’re considering.

2. Long-Term Perspective: Patience and the Power of Time

Just as Peter Lynch advocated for a long-term investment horizon in the stock market, he applied the same approach to art. In the stock market, Lynch would often hold stocks for years, allowing time to pass before realizing their full potential. Similarly, in art collecting, Lynch understood that art, like stocks, can take time to appreciate in value.

Many of the works in Lynch’s collection were not purchased with the expectation of immediate financial gain. Instead, he recognized that the value of art could grow over time, particularly when a piece had historical significance, was by a renowned artist, or simply had the potential to appreciate in value due to shifts in market demand. This long-term perspective allowed Lynch to make purchases that others may have overlooked.

For Lynch, patience was a critical part of the investment process. In the fast-moving world of art, trends come and go, but a well-selected piece of art—just like a solid stock investment—gains value when held over time.

Key Takeaway: Lynch’s investment philosophy in art reflects his broader strategy in the stock market: hold for the long term. For art investors, this means selecting works with lasting potential and allowing them to appreciate over time.

3. Value Investing: Seeking Undervalued Gems

One of Peter Lynch’s key strategies in stock picking was looking for undervalued stocks that the market had overlooked but which had strong growth potential. In the same way, he applied a value-investing mindset to art collecting. Lynch wasn’t looking for the most hyped-up works of the moment but sought out pieces that were underappreciated or underpriced relative to their potential value.

In the art world, this means searching for artists who have not yet reached their peak recognition or whose works are undervalued in the market. Just as Lynch bought stocks before they became widely recognized as “growth stocks,” he purchased art pieces from emerging artists who he believed had the potential to become more widely appreciated in the future. This approach required a great deal of research, foresight, and patience.

By searching for hidden gems, Lynch not only acquired works of art that had significant growth potential but also contributed to the recognition and success of lesser-known artists. This was similar to how he backed undervalued companies that eventually flourished in the stock market.

Key Takeaway: Lynch applied value investing principles to art, buying undervalued works with potential for appreciation. Aspiring art investors should look for works that are priced below their true value and have strong potential for future growth.

4. Diversification: A Balanced Art Portfolio

Lynch’s philosophy on diversification is one of the cornerstones of his investment approach. He advocated for spreading investments across different sectors to mitigate risk. In the art market, this translated into creating a diverse collection, one that spans multiple styles, artists, and periods.

Lynch didn’t focus exclusively on one type of art or one specific artist; rather, he sought out a range of works, from classic pieces by established artists to emerging contemporary art. This approach not only reduces risk but also allows an art investor to tap into different sectors of the market, each with its own growth potential and market trends.

For example, Lynch’s collection includes pieces from both traditional genres and modern, experimental works, ensuring that he was not overly reliant on any one style or artist. This diversification mirrors his broader stock market strategy, where he built a portfolio that was not overly dependent on any one stock or sector.

Key Takeaway: Just as in stocks, diversification is key in art investing. Building a collection with a variety of styles, artists, and periods can help mitigate risk and create opportunities for growth across different segments of the art market.

5. The Role of Research and Due Diligence

Another key aspect of Peter Lynch’s investment philosophy was his emphasis on thorough research and due diligence. Lynch is known for his deep dives into company fundamentals, industry trends, and financial health before making investment decisions. This approach is equally important in art collecting.

Lynch took the time to research the history of an artist, the provenance of the artwork, and the trends within the art market before making any purchase. By understanding the context surrounding each piece—its cultural significance, the artist’s background, and its place in the broader art world—Lynch was able to identify artworks that would not only appreciate in value but also resonate with his personal tastes and interests.

Research also helped Lynch avoid common pitfalls, such as purchasing pieces that were too speculative or overpriced. By doing the necessary legwork, Lynch was able to make informed decisions that led to the growth of his collection’s value over time.

Key Takeaway: Thorough research and due diligence are just as crucial in art investment as they are in stocks. By understanding the background and value of each piece, art investors can make smarter decisions and avoid unnecessary risks.

6. Emotional Connection: Investing in Art with Heart

While Peter Lynch is often associated with his analytical and numbers-driven approach to investing, he also believed in investing in things that you genuinely care about. This principle, though more often applied to stocks, translates seamlessly into the world of art. Lynch’s personal interest and emotional connection to the works he collected were key elements of his strategy.

For Lynch, art collecting was about more than just financial returns. It was a way to connect with history, culture, and creativity. His collection reflects his passion for art, and by investing in pieces that resonated with him on an emotional level, he was able to enjoy both the aesthetic value of his collection and its financial growth.

This emotional investment in art provided Lynch with an additional layer of satisfaction, as he was able to derive joy from the collection beyond its monetary value.

Key Takeaway: Art collecting, like stock investing, can be driven by a passion for the subject. For investors, it’s important to invest in pieces that not only have financial potential but also resonate on an emotional or intellectual level.

7. The Growth of the Art Market: A Macro View

Peter Lynch’s success was also built on his ability to understand macroeconomic trends and how they impacted the markets. He paid close attention to the economic conditions, industry shifts, and broader societal trends that could affect the growth of the stock market. In a similar vein, Lynch understood the broader forces that were shaping the art market, including global trends, the rise of contemporary art, and the increasing role of art as an alternative asset class.

As art became an increasingly popular investment in the global market, Lynch was able to capitalize on this trend by acquiring pieces at the right time. The growing demand for contemporary art, combined with an increasing number of high-net-worth individuals seeking to diversify into art, created a favorable market for art investors.

Key Takeaway: Understanding macroeconomic trends is vital for any investor. Lynch’s success in art collecting can be attributed, in part, to his ability to anticipate trends in the art market and adjust his collection accordingly.

Conclusion

Peter Lynch’s success in the art market demonstrates how the same disciplined approach to investing that made him a legend in the stock market can be applied to art collecting. By leveraging his investment philosophy—focusing on long-term value, thorough research, diversification, and emotional connection—Lynch was able to build a collection that grew in both cultural and financial value.

For art investors, Lynch’s approach provides a valuable framework: invest in what you understand, stay patient for the long term, seek out undervalued assets, and diversify your holdings. When these principles are applied with care and diligence, art can become not just a passion, but a profitable and lasting investment.