Introduction

The rare collectibles market has long been an arena for passionate enthusiasts and savvy investors. From art and coins to vintage cars and sports memorabilia, these items have held a unique place in cultural and financial history. However, as we approach 2025, the landscape of this market is undergoing significant transformation, influenced by a mix of technological advancements, changing consumer behavior, economic pressures, and the rise of new trends.

This article explores why the rare collectibles market is experiencing unprecedented changes in 2025, examining the key factors driving these shifts and how they are reshaping the way collectors and investors engage with the market.

1. The Rise of Digital Collectibles and NFTs

In recent years, digital collectibles have become a game-changer, and by 2025, they’re set to dominate the landscape. Non-fungible tokens (NFTs) and blockchain-based collectibles have redefined what it means to own rare items. Unlike traditional physical collectibles, NFTs provide a way to digitally verify scarcity, ownership, and authenticity.

Key Points:

- Blockchain Technology and NFTs: Built on blockchain, NFTs offer an immutable digital record of ownership. With this, collectors can buy, sell, and trade rare digital assets in a secure, transparent manner. Art, music, videos, and even virtual real estate are now being sold as NFTs, gaining massive traction in the market.

- Virtual Art and Digital Scarcity: Digital art is being recognized as valuable, not because it can be replicated but because it can be uniquely verified through blockchain. The notion of scarcity is still preserved in the digital world, making NFTs highly desirable.

- Virtual Collectibles and Gaming: Video game collectibles, virtual skins, and in-game items are increasingly being sold as NFTs. The gaming industry has introduced a new generation of collectors who value digital assets, further fueling the NFT market.

- Physical and Digital Hybrid Collectibles: 2025 marks the growing trend of hybrid collectibles, where buyers can own both a physical and a digital version of the same item, giving rise to a new form of ownership and investment.

2. Economic Factors and Changing Consumer Behavior

The economic environment has always influenced the rare collectibles market, but in 2025, we are seeing a confluence of factors that are driving an uptick in demand for rare items. Inflation, wealth distribution, and shifting consumer priorities all play a role in how people invest in collectibles today.

Key Points:

- Economic Uncertainty and Inflation: Amid rising inflation and global economic uncertainty, many investors are turning to rare collectibles as a form of wealth preservation. Items like fine art, vintage cars, and rare coins have become reliable assets that tend to appreciate in value over time, making them an attractive hedge against inflation.

- Shift in Investment Behavior: As traditional investment avenues like stocks and bonds see increased volatility, high-net-worth individuals (HNWIs) and younger investors alike are diversifying into the collectibles market. This shift is being driven by both financial considerations and a desire to own tangible, culturally significant assets.

- Post-Pandemic Reflections: Following the COVID-19 pandemic, many individuals reevaluated their priorities. Collecting rare items, often tied to nostalgia, passion, or historical significance, has surged in popularity. This desire for physical, meaningful objects contrasts sharply with the rise of virtual worlds.

- Emerging Markets and New Wealth: Asia, the Middle East, and Africa are seeing a new generation of wealthy individuals emerging, with a growing appetite for luxury collectibles. As the global economy shifts, these markets will play an increasingly prominent role in driving demand for rare items.

3. The Role of Auctions and the Influence of Social Media

The traditional model of the auction house is evolving in response to the digital era, and in 2025, online auctions and social media are becoming central to the rare collectibles market. This has made collecting more accessible and more competitive than ever.

Key Points:

- Online Auction Houses: Major auction houses like Sotheby’s and Christie’s have already embraced digital platforms, offering online auctions that open up the market to a global audience. The increased reach has led to higher bid prices, greater market liquidity, and a more transparent process.

- Social Media and Market Trends: Platforms such as Instagram, TikTok, and YouTube are becoming essential tools for collectors and investors. These social networks provide a real-time look into market trends, influencer-driven valuations, and the latest acquisitions, influencing both demand and supply in the collectibles market.

- Live Streaming and Real-Time Bidding: With the rise of live streaming, auctions are no longer confined to traditional venues. Auctions can now be viewed and participated in from anywhere in the world. The excitement of live bidding has added a new dimension of engagement to the process, further driving demand for rare collectibles.

- Crowdsourced Investments and Fractional Ownership: Social media and crowdfunding platforms have given rise to group investments in high-value collectibles. This allows collectors to pool resources, making it possible for more people to invest in rare items that they might not otherwise afford.

4. The Evolution of Collectible Categories

The nature of what is considered valuable in the world of collectibles is changing. As tastes shift and new generations enter the market, unconventional and previously niche categories are now being recognized as valuable investments.

Key Points:

- Pop Culture Memorabilia: Items from movies, television shows, and music are gaining importance as collectors look to secure pieces of pop culture history. Memorabilia from blockbuster films, limited-edition concert posters, and rare music-related items have seen their values skyrocket in recent years. This trend is expected to continue through 2025, as millennials and Gen Z collectors increasingly turn their attention to media-driven collectibles.

- Sports Memorabilia: Sports collectibles, including jerseys, game-worn equipment, and autographed items, are seeing significant growth. High-profile athletes and iconic sports moments are now being immortalized in both physical and digital formats (e.g., NFTs), allowing fans to connect with their favorite teams and players in new ways.

- Vintage Cars and Luxury Watches: The market for high-end luxury items, including vintage cars and rare watches, continues to grow. Classic cars, in particular, have seen incredible appreciation, with certain models now fetching millions at auction. Watches, often viewed as a symbol of status, are similarly growing in value, with limited-edition pieces seeing especially high returns.

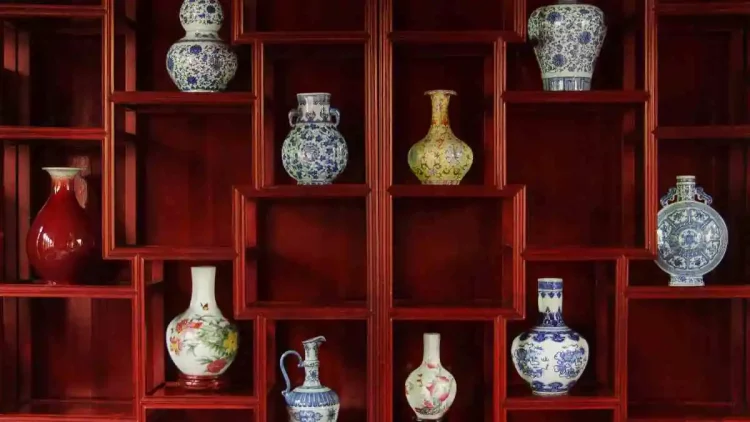

- Historical Artifacts and Antiquities: Despite the rise of digital collectibles, historical items like manuscripts, rare books, and ancient relics remain highly sought after. These items carry intrinsic value, and their rarity—combined with their cultural and historical significance—continues to make them a top choice for discerning collectors.

5. Environmental and Ethical Considerations in Collecting

As the world becomes more environmentally conscious, the rare collectibles market is beginning to respond to ethical and sustainability concerns. Consumers and investors are increasingly considering the environmental impact of their acquisitions and opting for sustainable alternatives.

Key Points:

- Sustainability in Collectibles: Consumers are increasingly seeking eco-friendly alternatives. Collectibles made from sustainable materials or those produced with minimal environmental impact are gaining attention. Whether it’s through carbon-neutral packaging or sourcing materials from responsible suppliers, the green movement is starting to take hold in the collectibles market.

- Ethical Sourcing and Provenance: Transparency regarding the provenance and sourcing of items is becoming a significant consideration. Collectors are more aware of the ethical implications of their acquisitions, particularly in cases where items may have been looted, stolen, or acquired under questionable circumstances. Blockchain technology is also helping to verify provenance and ensure authenticity.

- Carbon Footprint of Physical Collectibles: The carbon footprint of transporting and maintaining rare physical items has raised concerns. Digital collectibles, such as NFTs, are seen by some as a more sustainable alternative, as they don’t require the same level of physical production and transport.

Conclusion

The rare collectibles market in 2025 is undergoing significant transformations, driven by technological innovation, economic factors, shifting consumer behaviors, and global trends. From the rise of NFTs to the impact of social media and the growing emphasis on sustainability, the market is becoming more dynamic and diverse than ever before. Collectors and investors who can adapt to these changes will find exciting opportunities, but staying informed and understanding the forces shaping the market will be key to success in this evolving space.