In the world of collectibles, market trends are often cyclical. What is once considered worthless or overhyped can sometimes regain value, driven by nostalgia, renewed interest, or shifting economic conditions. One of the most intriguing trends in the collectibles market today is the apparent resurgence of bubble-era collectibles—items that were once highly sought after during the so-called “collector’s bubble” of the late 20th and early 21st centuries. These were the items that saw prices skyrocket, only to plummet when the market corrected itself. But recent auction data suggests that these very same collectibles are making a surprising comeback.

This article explores the resurgence of previously overhyped collectibles, examines the data behind this revival, and identifies which vintage trends are gaining traction at auctions. Is this a fleeting phase, or are bubble-era collectibles truly on the verge of a long-term recovery?

The Bubble-Era Collectibles: A Brief Overview

Before we dive into the current trends, it’s essential to understand what we mean by “bubble-era” collectibles. The bubble era typically refers to a time during the late 1980s to the early 2000s, when certain categories of collectibles became wildly overinflated. These items—often driven by speculative investors—saw enormous price increases, only to crash once the bubble burst.

Some of the most well-known bubble-era collectibles include:

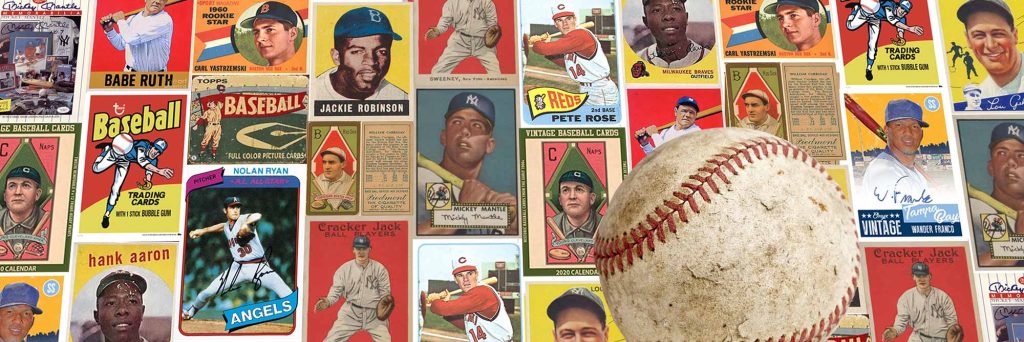

- Baseball Cards: In the late ’80s and early ’90s, baseball cards became a hot commodity, with some individual cards selling for tens of thousands of dollars. The market was flooded with overproduction, and many cards quickly lost value.

- Beanie Babies: The Beanie Baby craze in the mid-1990s reached a fever pitch, with collectors paying absurd amounts for these small, stuffed animals. As the bubble burst, many Beanie Babies became essentially worthless.

- Comic Books: In the late ’80s and early ’90s, comic books, particularly limited edition runs and first appearances, were touted as investment-grade items. The market eventually corrected itself, and many of these comics lost much of their value.

- Sports Memorabilia: Limited-edition jerseys, autographed equipment, and other sports memorabilia also saw inflated prices during this time, with many items selling for far more than they were worth.

- Coins and Stamps: Collectible coins and rare stamps saw periods of skyrocketing demand, only to fall sharply when collectors realized many items were not as rare as initially believed.

During the bubble years, the market for these items was driven not just by collectors but also by investors looking to profit. However, when the market inevitably corrected itself, many of these collectibles became much less valuable. The value of these items fell as quickly as they had risen, leaving many collectors and investors holding depreciated assets.

Auction Data: A Surprising Resurgence

Fast forward to today, and auction data suggests that some of these once-devalued collectibles are making a comeback. Over the past few years, auction houses have noticed an uptick in demand for certain categories that were previously dismissed as “bubble-era flukes.” This trend is particularly pronounced in collectibles that have strong emotional ties to specific generations, as well as those that have acquired a nostalgic value over time.

While it’s easy to dismiss the resurgence of bubble-era items as a mere blip on the radar, the consistent data from major auction houses paints a compelling picture. Auction results over the last few years reveal that certain vintage trends are seeing renewed traction, and it appears that collectors are once again willing to pay a premium for these items. So, what categories are leading this unexpected resurgence?

Vintage Sports Cards: Back on the Rise

Among the most notable trends is the revival of vintage sports cards. After the market collapse in the late ’90s, baseball cards and other sports memorabilia saw a long period of stagnation. However, recent auction data shows a dramatic increase in the sale prices of certain vintage cards, especially those from pre-1980s players.

Several factors contribute to this resurgence. First, many collectors who grew up during the bubble era have now returned to the market as they seek to recapture their childhood memories. Secondly, the recent rise in popularity of sports memorabilia as an investment asset has driven up demand. Collectors are also increasingly attracted to rare or “grade 10” cards, which represent the highest possible condition. Cards featuring legendary players like Babe Ruth, Mickey Mantle, and Michael Jordan have seen record prices in recent years, surpassing the market highs seen during the bubble era.

One particularly striking example comes from the sale of a 1952 Mickey Mantle card, which fetched over $5 million at auction in 2021. This record-breaking sale indicates a growing recognition of vintage sports cards as more than just nostalgic items but as valuable assets.

Beanie Babies: The Return of the Plush

For many, the Beanie Baby bubble of the 1990s remains one of the most memorable examples of speculative collecting gone wrong. After the bubble burst, Beanie Babies were widely seen as worthless. However, certain Beanie Babies have been showing surprising increases in auction prices.

Why is this happening? Part of the reason is nostalgia. Many collectors who grew up during the Beanie Baby craze are now in their 30s or 40s and are looking to recapture the joy they experienced as children. Furthermore, Beanie Babies were often marketed as “limited editions,” creating a perception of scarcity. Even though many of these toys are no longer rare, some of the original first-edition Beanie Babies, particularly those in pristine condition with their tags still attached, are fetching impressive prices.

For example, a rare “Princess Diana” Beanie Baby, produced in limited quantities to honor the late princess, sold for over $100,000 in an online auction in 2022. Although these prices remain far below their peak, the resurgence of interest is undeniable.

Comic Books: From Speculative Hype to Collectible Value

The comic book market was one of the earliest and most dramatic victims of the bubble era. During the 1990s, publishers flooded the market with special edition comics, often with the promise that they would appreciate in value. After the market corrected itself, many of these comics were left devalued and overproduced. However, the past few years have seen a slow and steady resurgence in the comic book market.

While the overproduction of the 1990s continues to hurt certain titles, other vintage comics have gained considerable value, particularly key issues featuring iconic characters and first appearances. In particular, comics from the “Golden Age” of the 1940s and 1950s, such as Action Comics #1 (the first appearance of Superman), have seen record prices in recent years. Auction houses have also seen strong demand for limited-edition comics, especially those related to blockbuster film franchises like Marvel and DC.

Factors Driving the Resurgence of Bubble-Era Collectibles

Several factors are contributing to the surprising comeback of bubble-era collectibles. One of the most significant is the aging of the collector demographic. As individuals who grew up in the bubble years reach adulthood and become more financially stable, they are revisiting the collectibles market. This demographic is increasingly interested in acquiring items from their childhood that were once considered out of reach or too expensive.

Another key factor is the growing recognition of collectibles as an alternative investment class. As traditional investment markets become more volatile, many investors are turning to rare collectibles as a store of value. The increasing popularity of online auction platforms and the ease of access to a global pool of bidders have also contributed to the rising demand for collectibles.

Finally, nostalgia is an undeniable force. Collectors who grew up during the bubble era often have a deep emotional connection to the items they once owned. As they approach middle age, the desire to recapture the past and hold onto tangible memories drives interest in these collectibles.

Conclusion: Are Bubble-Era Collectibles Here to Stay?

While it’s impossible to predict the future of the collectibles market with certainty, the current resurgence of bubble-era items appears to be more than just a temporary phase. Auction data shows that vintage sports cards, Beanie Babies, and comic books are gaining traction, driven by a combination of nostalgia, investment potential, and emotional attachment.

However, it’s important to remember that not all bubble-era collectibles are destined for a second act. Some categories may remain in decline, while others may never fully recover to their previous highs. Nevertheless, the resurgence of certain vintage trends suggests that the collectibles market is far from static, and trends that seemed defunct may yet find new life in the hands of new collectors and investors.

As we look to the future, one thing is clear: in the world of collectibles, the line between value and nostalgia is often more fluid than we realize.